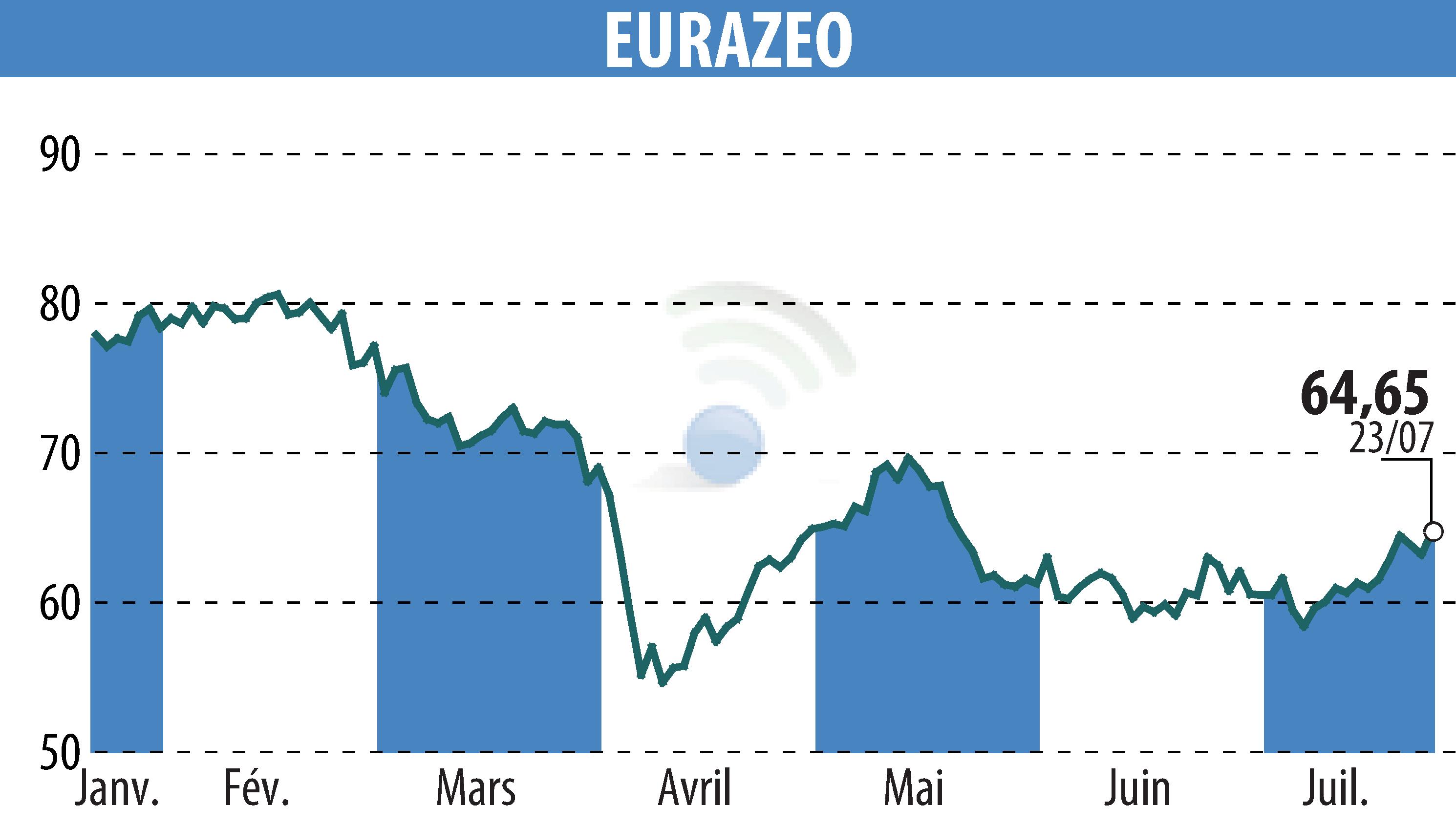

on EURAZEO (EPA:RF)

EURAZEO Reports Steady Growth and Asset Rotation in H1 2025

In the first half of 2025, Eurazeo exhibited strong asset management results, maintaining a consistent third-party fundraising amount of €2.1 billion, mirroring H1 2024 levels. The company reported an increase in total Assets Under Management (AUM) by 4% to €36.8 billion, with a notable 10% rise in third-party AUM. Fee-paying AUM also grew by 8% to €27.8 billion. However, the group shared a net loss of €0.3 billion compared to €0.1 billion in the previous year, primarily impacted by a decrease in portfolio fair value and negative currency effects.

During the period, Eurazeo announced and completed divestments equivalent to 12% of its balance sheet portfolio, up from 9% in the same period of 2024. The company plans to continue this momentum, expecting further asset rotations and exits throughout 2025. Management fees saw a noticeable increase, with third-party fees up by 6%, contributing to an overall asset management activity contribution increase of 9%, excluding financial expenses.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all EURAZEO news