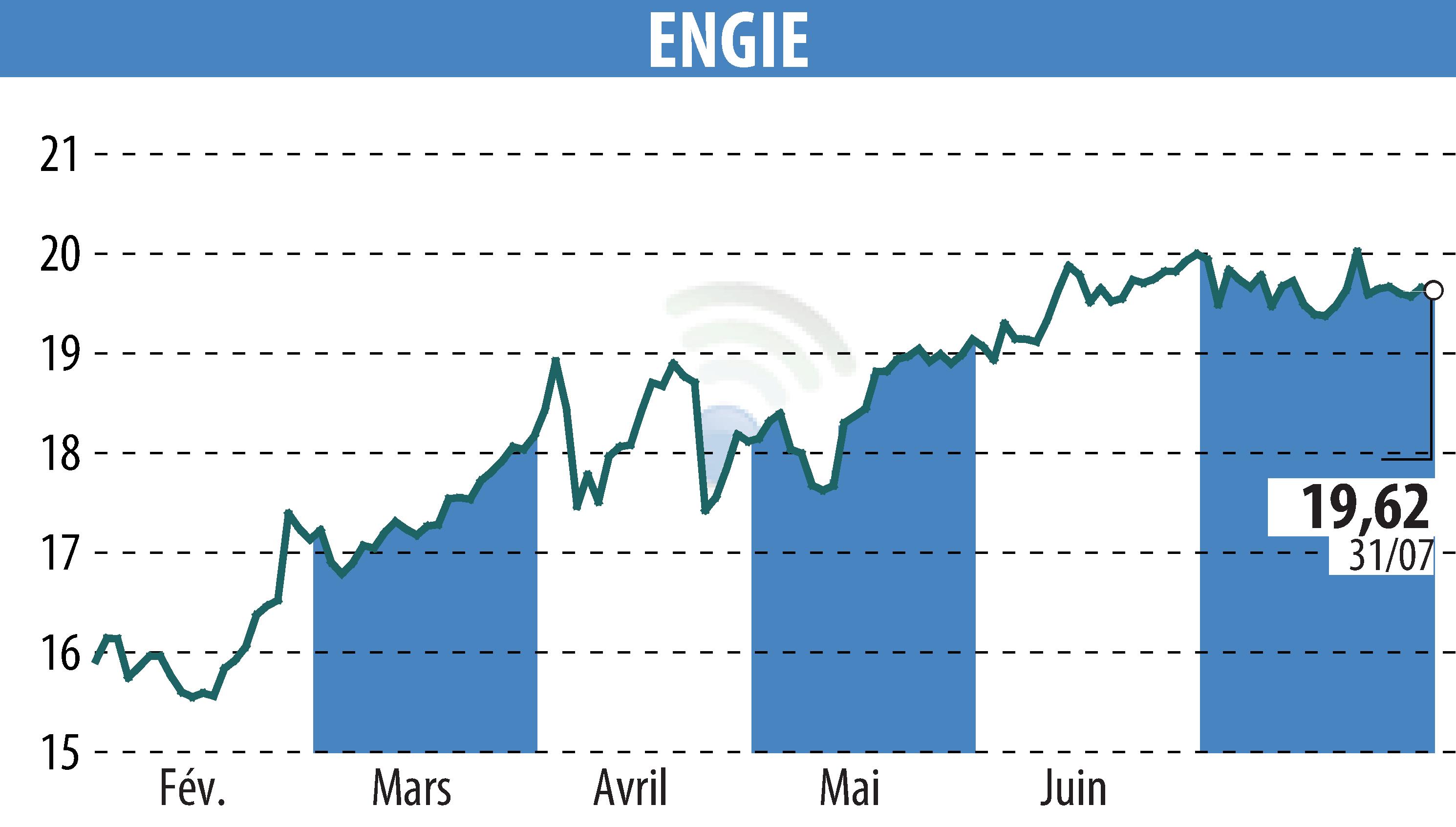

on ENGIE (EPA:ENGI)

ENGIE Reports Solid H1 2025 Financial Results Amid Economic Challenges

ENGIE today announced its financial results for the first half of 2025, highlighting robust operational achievements despite a decrease in EBIT excluding Nuclear by 6.4% on an organic basis. The company's performance comes in the context of lower energy prices compared to 2024. Revenue increased to €38.1 billion, marking a 2.9% organic growth.

Operating cash flow reached €8.4 billion, reflecting strong cash generation. Yet, a 9.4% drop in EBIT excluding Nuclear highlights the impact of challenging market conditions. Despite these hurdles, ENGIE reduced its economic net debt by €1.1 billion to €46.8 billion and maintained a stable net debt/EBITDA ratio of 3.1x. The firm confirmed its full-year guidance with expected net recurring income between €4.4 and €5.0 billion.

Key achievements include the commissioning of major renewable energy projects in Egypt and France, and progress in securing a PPA for a solar project in the UAE. Meanwhile, ENGIE's French LNG terminals achieved a 87% utilization rate. The company also enhanced its investment in geothermal energy in Île-de-France.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ENGIE news