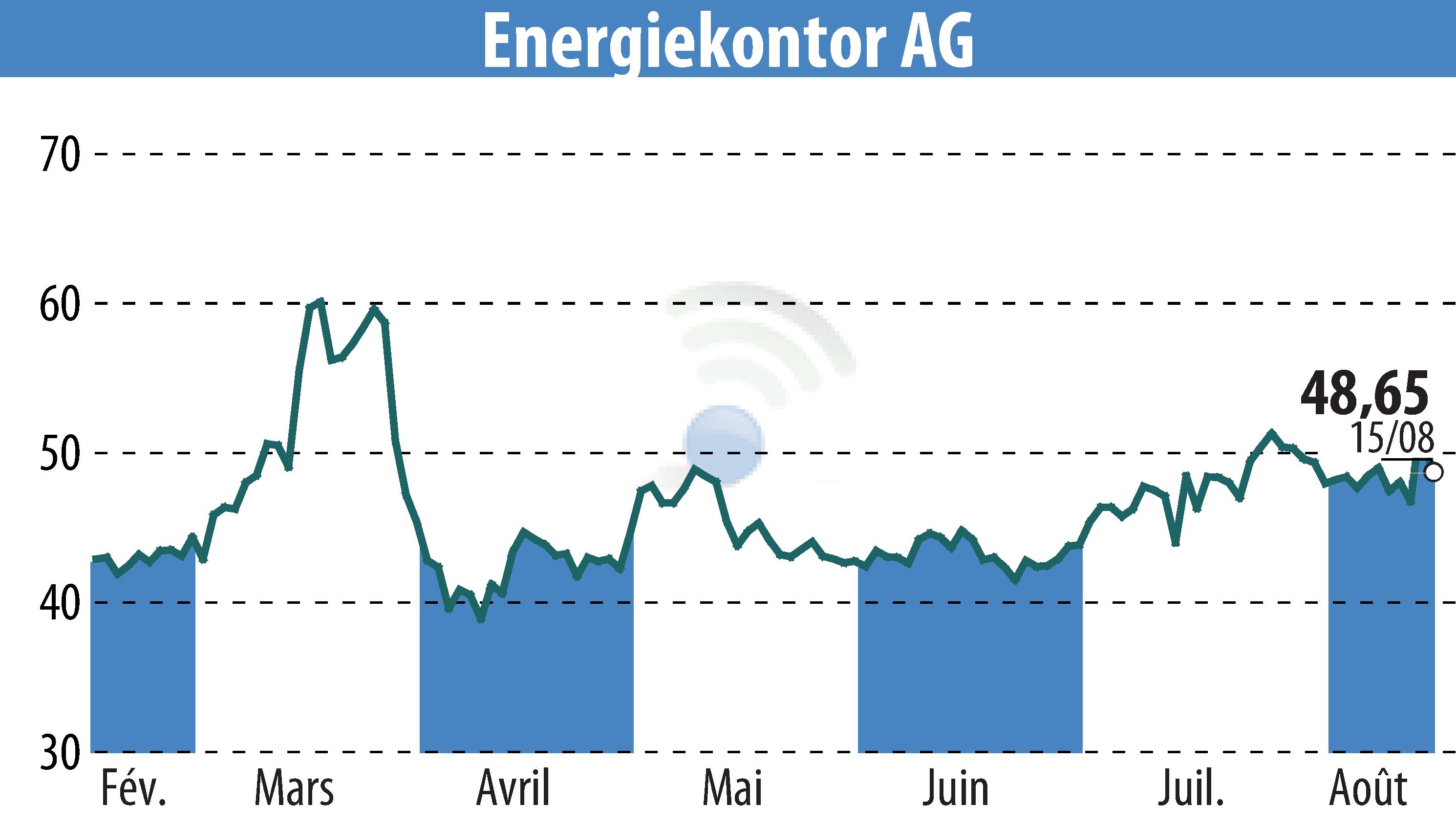

on Energiekontor AG (ETR:EKT)

Energiekontor AG Achieves Robust H1 Performance

A recent research update by First Berlin Equity Research GmbH highlights significant growth in Energiekontor AG's performance for the first half of 2025. The company reported a 79% year-on-year increase in total output, reaching €171 million, driven by strong construction activity. Additionally, the Earnings Before Taxes (EBT) rose by 69% to €28.3 million, a notable achievement for what is typically a weaker half-year.

Looking forward, Energiekontor plans to sell further projects, aligning with the company's 2025 EBT guidance of €70 million to €90 million. The management remains optimistic, maintaining a 2028 EBT target of €120 million. Despite a rise in share price, the stock is considered attractively valued with a projected 2026 P/E ratio of 9. Though forecasts for 2025 were adjusted downward due to weak wind conditions in H1, the Buy rating stands firm with an unchanged target price of €105, offering a potential upside of 115%.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Energiekontor AG news