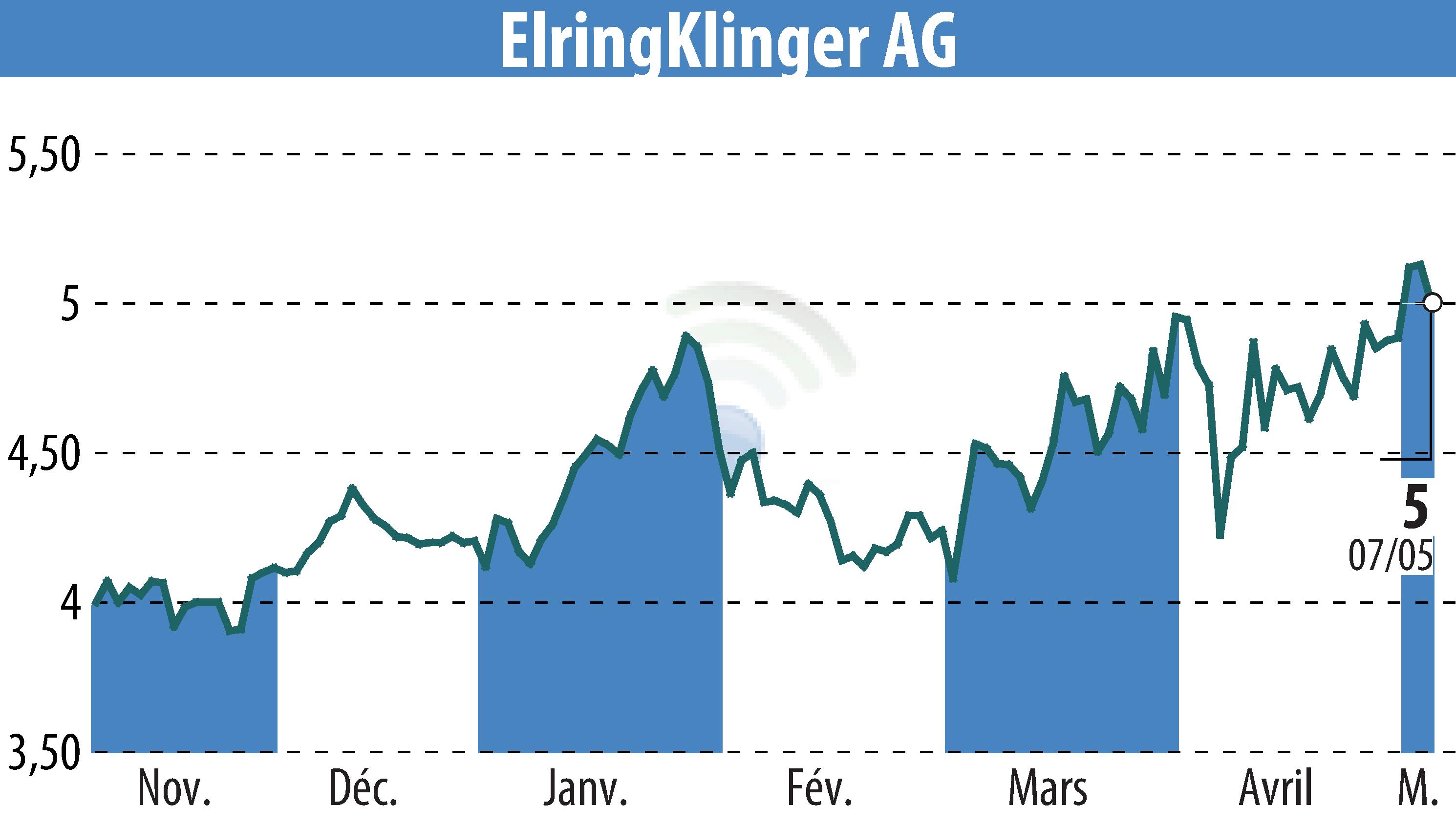

on ElringKlinger AG (ETR:ZIL2)

ElringKlinger's Q1 2025 Performance and Transformation Strategy

In Q1 2025, ElringKlinger AG reported EUR 423.1 million in revenue, a decrease from EUR 465.3 million in Q1 2024. Yet, in organic terms, revenue improved by 2.2%. The adjusted EBIT margin stood at 4.9%, aligning with the annual target of around 5%. Operating free cash flow was EUR -120.3 million, largely due to investments.

The company has launched the STREAMLINE cost reduction program, aiming for annual savings of at least EUR 30 million from 2026 onward. This initiative is part of ElringKlinger's strategy to enhance competitiveness by focusing on profitable business segments.

Notably, the E-Mobility unit more than doubled its revenue, driven by demand for cell contacting systems in Germany. The company's future-oriented steps include preparations for production in China and expanding operations in the United States.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ElringKlinger AG news