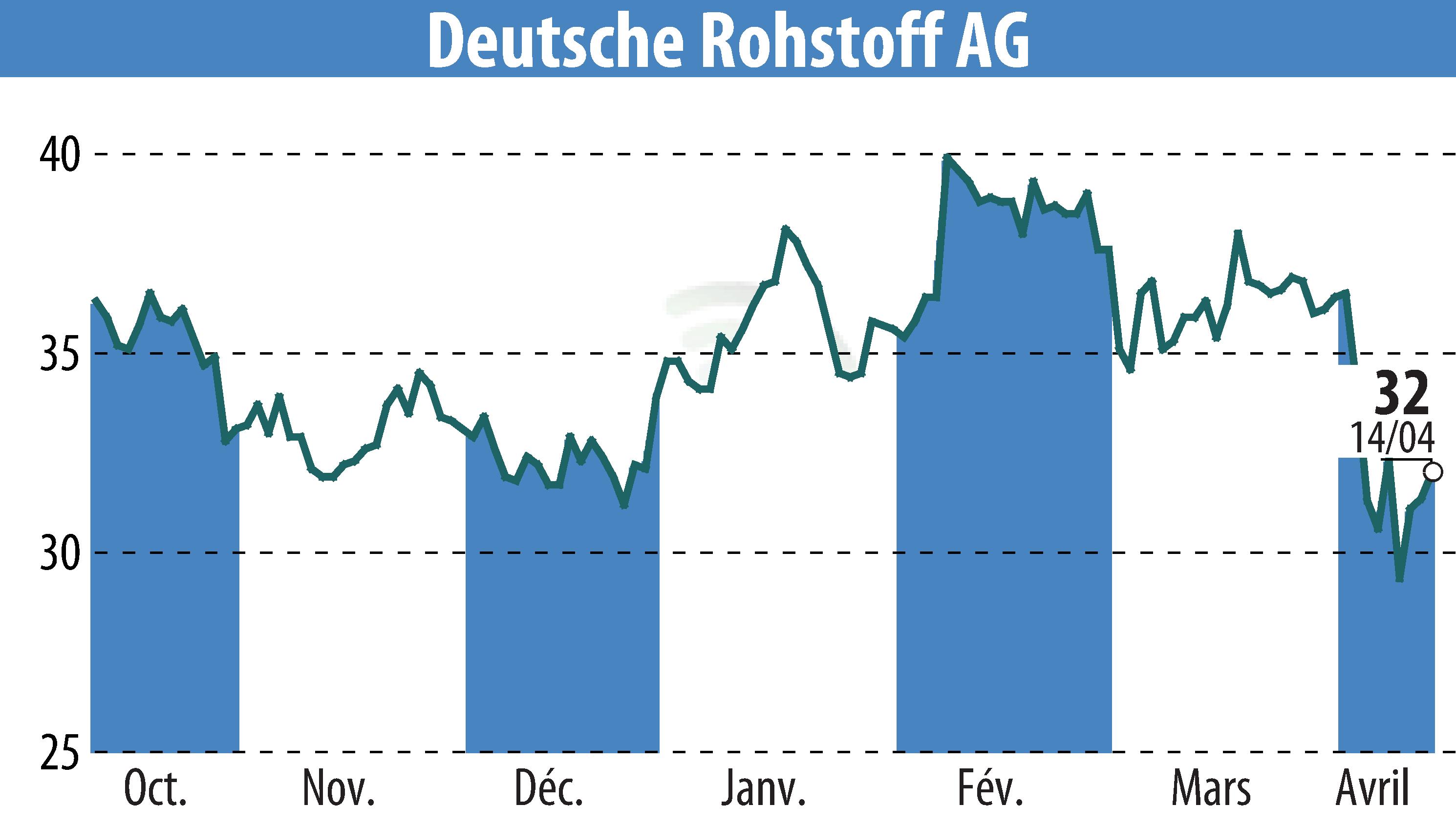

on Deutsche Rohstoff AG (ETR:DR0)

Deutsche Rohstoff AG Considers Bond Expansion Amid High Demand

Deutsche Rohstoff AG is contemplating an increase in its corporate bond 2023/2028 volume due to high demand from investors. The bond, trading at an average of 110% over the past 30 days, reflects market confidence. The additional funds are intended to reduce the US credit line and increase liquidity for new opportunities, thereby reducing financing costs.

The company reported a strong EBITDA of EUR 168 million in 2024, with net debt decreasing to EUR 134 million by the first quarter of 2025. Despite lower oil prices, Deutsche Rohstoff remains secure with robust reserves and a strong hedge book, enabling steady cash flows. The company plans to utilize its liquidity advantages, aided by a stronger Euro, to hedge against exchange rate risks.

The firm has mandated agents to evaluate the potential bond increase, aiming to bolster its financial flexibility and pursue growth amid fluctuating oil prices.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Deutsche Rohstoff AG news