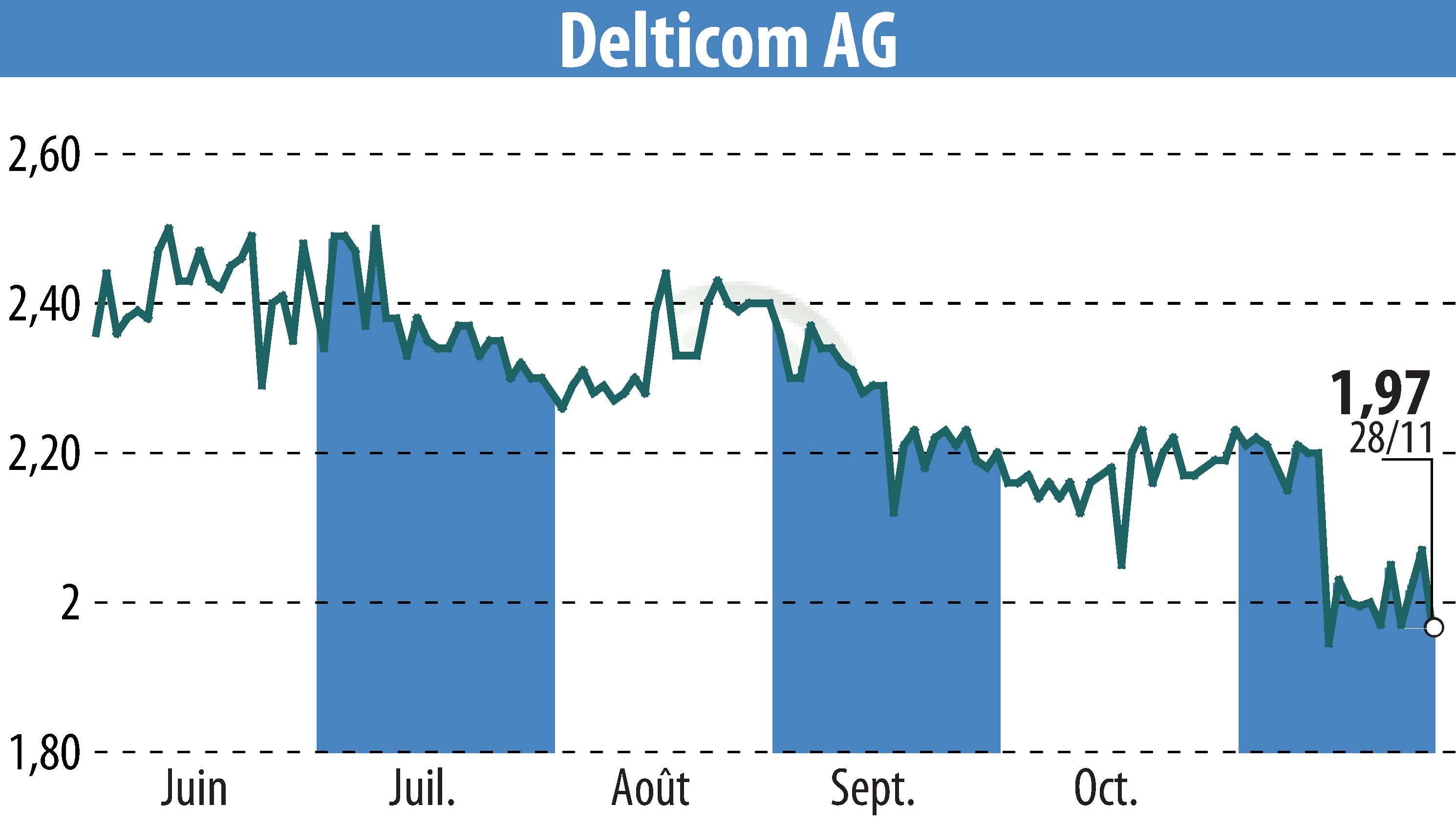

on Delticom AG (ETR:DEX)

Delticom AG Anticipates Robust Q4 Amid Revenue Forecast Increase

In a recent research report by Quirin Privatbank Kapitalmarktgeschäft, Delticom AG has been classified with a "BUY" recommendation. The company shows promise in Q4, raising its revenue forecast for 2025 to a range of EUR 490m to EUR 510m, up from the previous EUR 470m to EUR 490m. This adjustment follows solid Q3 performance and a positive start to winter tire sales.

Current weather conditions in Europe may have bolstered demand, aiding in the upward revision. Despite negative consumer sentiment in Germany, Delticom continues to achieve top-line growth, supported by pricing strategies. The European Union's ongoing tariff procedures against Chinese tires could also impact market dynamics, potentially benefiting Delticom. As such, their fair value is set at EUR 3.80.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Delticom AG news