on DATAGROUP IT Services Holding AG (ETR:D6H)

Datagroup SE: Q2 Financial Results and Strategic Developments

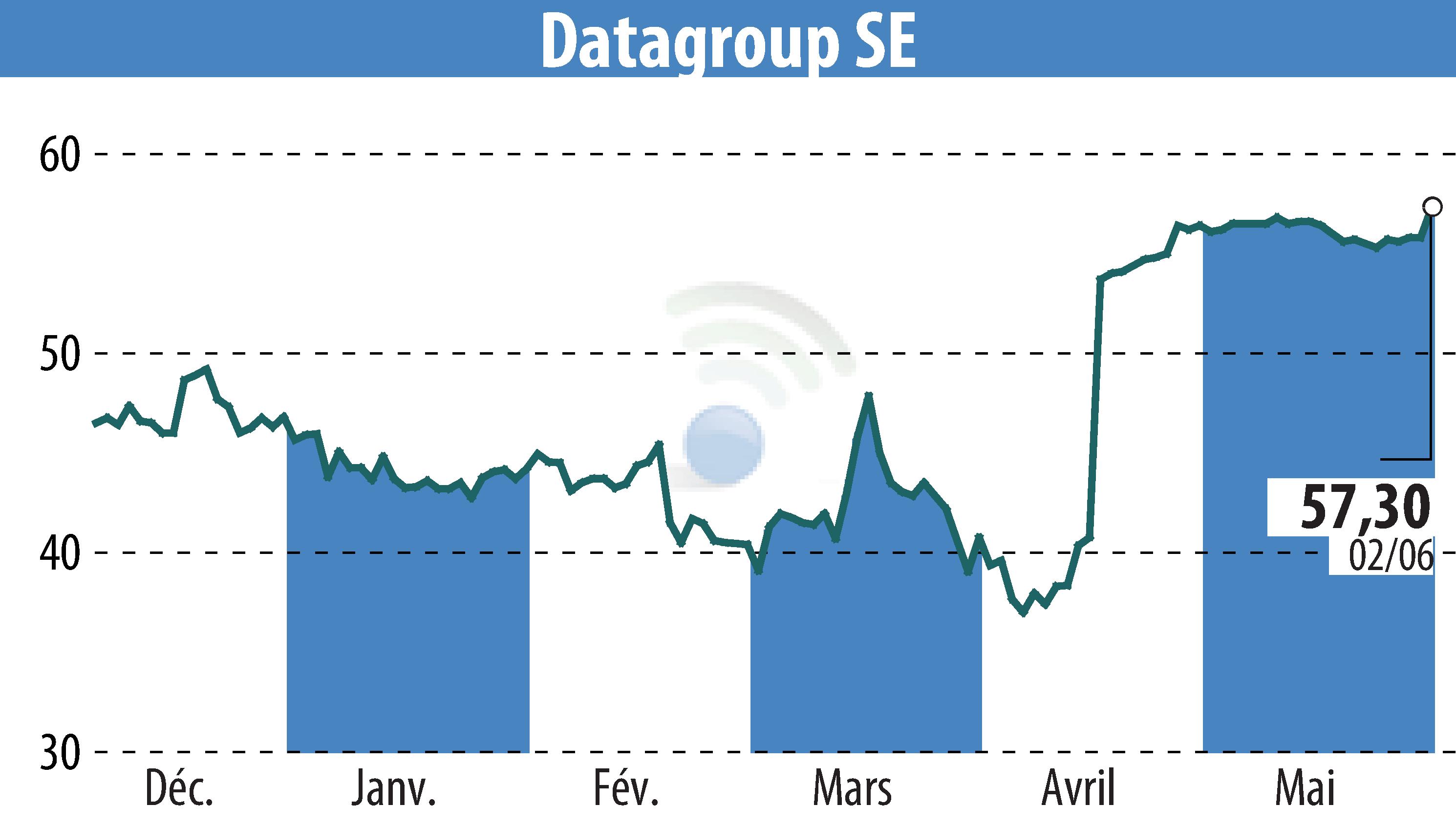

Datagroup SE recently announced its Q2 financial performance, showing a significant 10.1% year-on-year revenue increase. This growth was driven by strong order intake in its CORBOX business, along with successful customer acquisitions and enhanced cross- and upselling efforts. The company also experienced a higher share of hardware in its service mix, albeit impacting profit margins due to typically lower returns from hardware sales.

Datagroup continues to invest in AI, cybersecurity, and cloud services, reinforcing its strategic goals, though these investments have affected earnings. The EBIT margin slightly decreased to 8.1%. Meanwhile, cash flow from operations faced challenges due to increased trade receivables.

Additionally, a public tender offer by KKR remains a central focus. If KKR achieves the required acceptance thresholds by 6 June 2025, the offer price will rise, with a potential delisting to follow. Quirin Privatbank Kapitalmarktgeschäft updated Datagroup's rating to 'Hold' with a new target price aligned at EUR 58.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all DATAGROUP IT Services Holding AG news