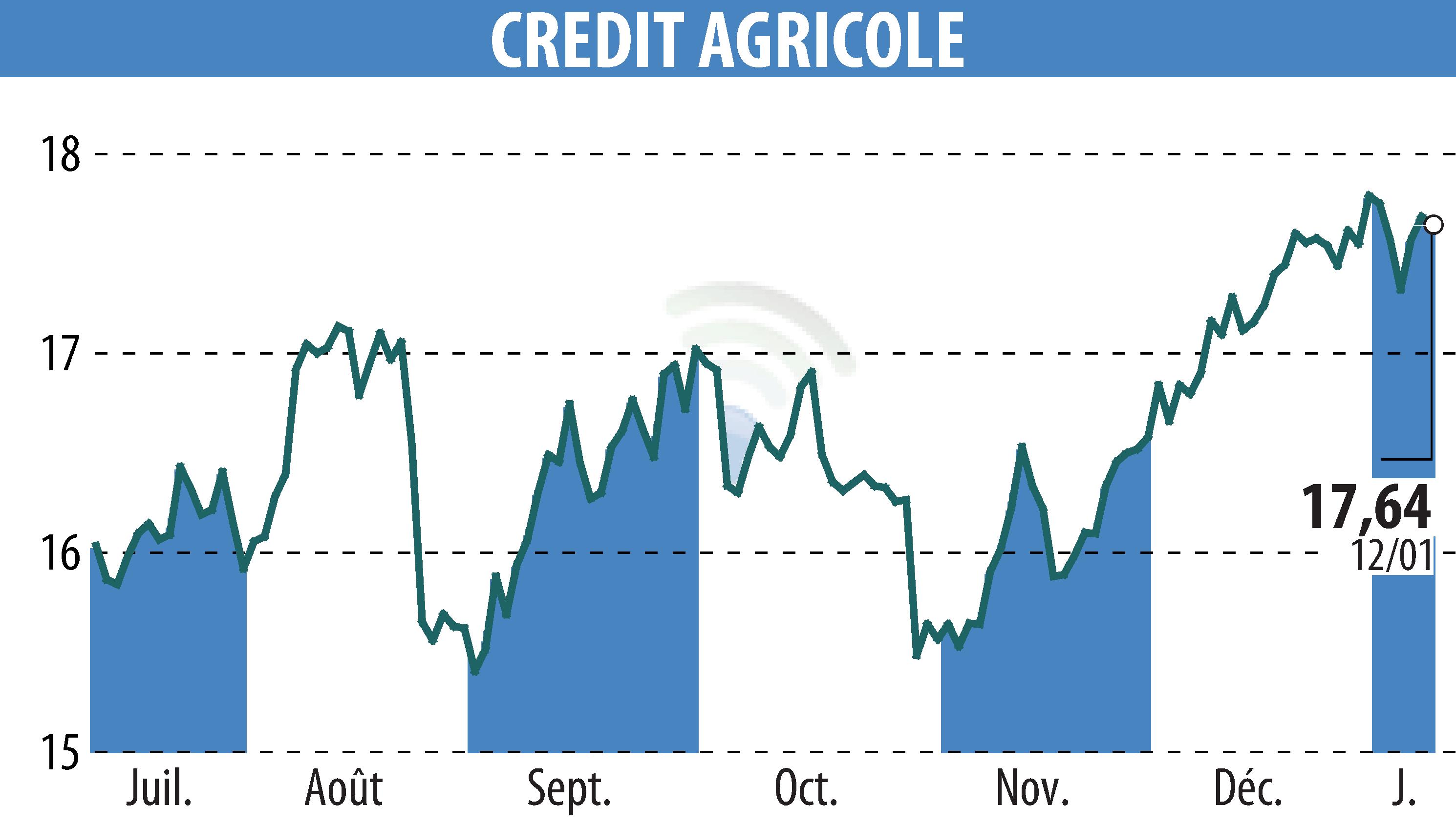

on CREDIT AGRICOLE (EPA:ACA)

Crédit Agricole crosses the 20% threshold of Banco BPM's capital with the approval of the ECB

On January 9, 2026, Crédit Agricole SA received authorization from the European Central Bank to exceed the 20% ownership threshold in Banco BPM. This decision is part of an investment strategy initiated in the third quarter of 2025, notably through the acquisition of instruments related to Banco BPM shares and a derivatives position representing 0.3% of the share capital. Crédit Agricole SA's objective is to hold 20.1% of the Italian bank's share capital.

Despite this capital increase, Crédit Agricole SA is not seeking to take control of Banco BPM, as its stake will remain below the threshold triggering a mandatory public tender offer. From an accounting perspective, the initial impact is estimated at -€600 million, while the effect on 2025 earnings is positive, at approximately €200 million. The consolidation also has a positive impact of 5 basis points on the CET1 ratio.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all CREDIT AGRICOLE news