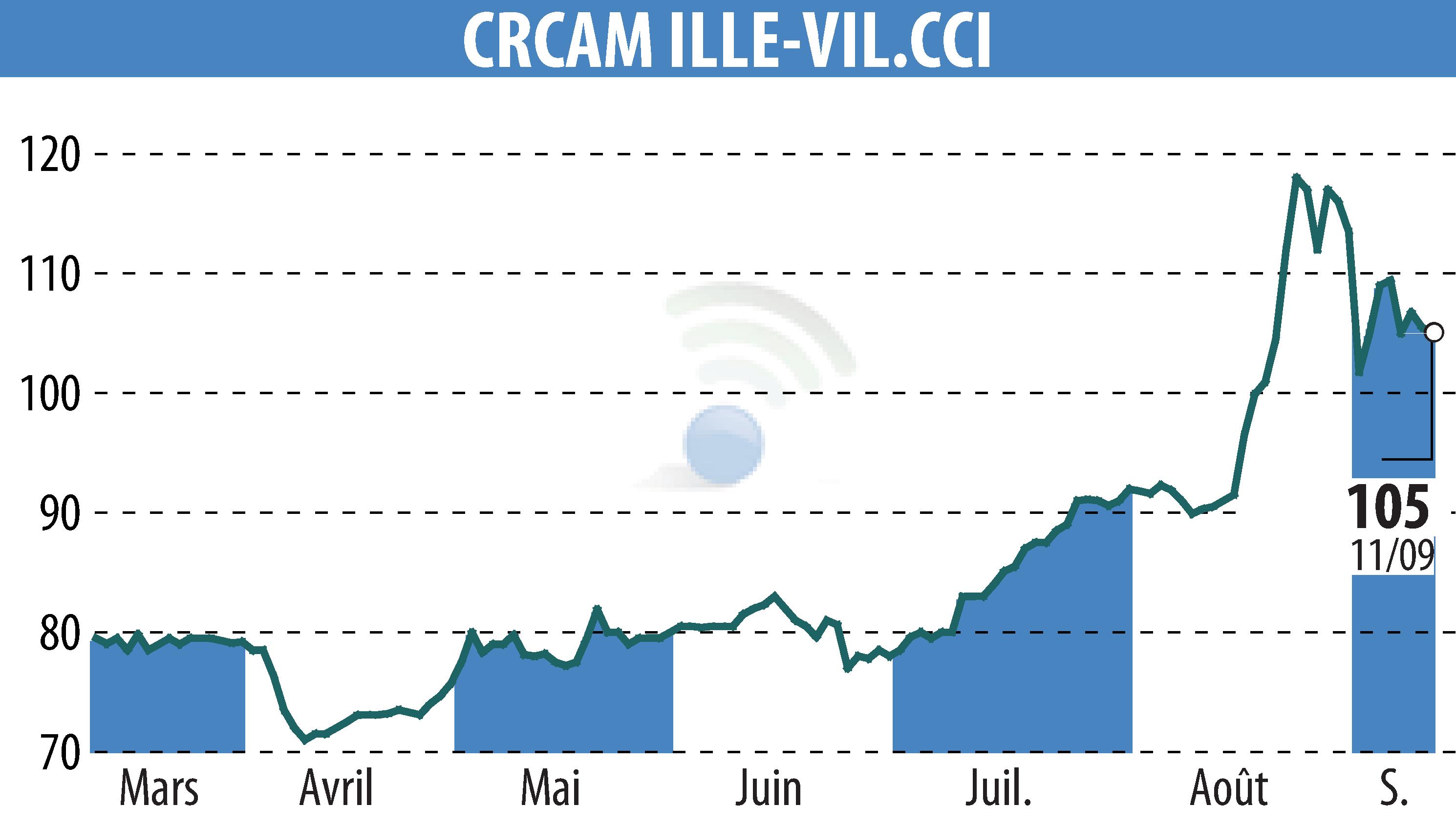

on CREDIT AGRICOLE D'ILLE-ET-VILAINE (EPA:CIV)

Crédit Agricole d'Ille-et-Vilaine: Financial Ratios as of June 30, 2025

Crédit Agricole d'Ille-et-Vilaine has published its key indicators as of June 30, 2025, in accordance with the requirements of the European banking regulation. Prudential ratios, including solvency, leverage, and liquidity ratios, comply with current regulatory standards. Common Equity Tier 1 (CET1) capital stands at €1,283,509 thousand, marking a slight increase compared to December 2024.

The Tier 1 capital ratio stands at 19.42%, while the leverage ratio stands at 6.77%. The liquidity coverage ratio stands at 113.39%, reflecting a strong liquidity position. Capital requirements for risks other than excessive leverage remain at 0%, ensuring financial stability.

Finally, the Net Stable Funding Ratio (NSFR) stands at 106.41%, highlighting prudent management of financial resources. These results illustrate the entity's financial strength.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all CREDIT AGRICOLE D'ILLE-ET-VILAINE news