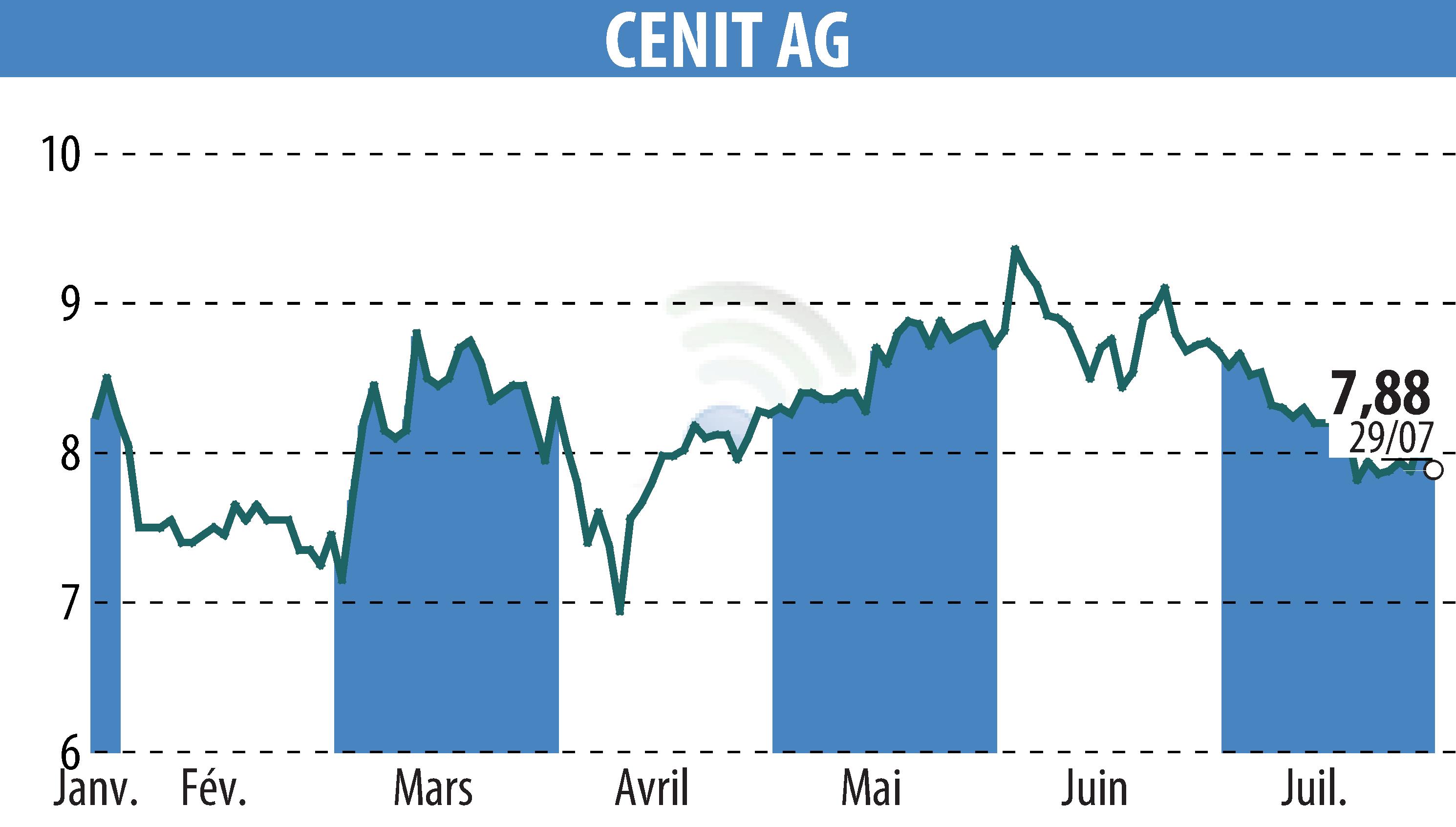

on CENIT AG (ETR:CSH)

CENIT Reports Record Half-Year Sales Amid Economic Challenges

CENIT AG has announced a remarkable achievement, recording its strongest half-year sales in history with revenues reaching 103.7 million euros, marking a 4.4% increase compared to the previous year. Despite this success, economic hurdles have led to a revised forecast for the year. The company reported an EBIT of -3.7 million euros, affected by the underperformance of its US subsidiary, Analysis Prime, and challenges within its PLM segment.

Analysis Prime, acquired in 2024, showed a negative result of -1.6 million euros, while the ongoing PLM transformation impacted results by -3.8 million euros. Nevertheless, CENIT maintained stable operating cash flow at around 10% of revenue. The management anticipates at least 205 million euros in revenue for 2025, with an EBIT forecast updated to at least -1.5 million euros.

Sales in CENIT's consulting and services segment grew by 12%, though third-party software sales decreased slightly. Equity saw a decline, while cash and equivalents improved, highlighting a mixed financial landscape. CENIT's medium-term targets remain unchanged, with expectations of a temporary slowdown.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all CENIT AG news