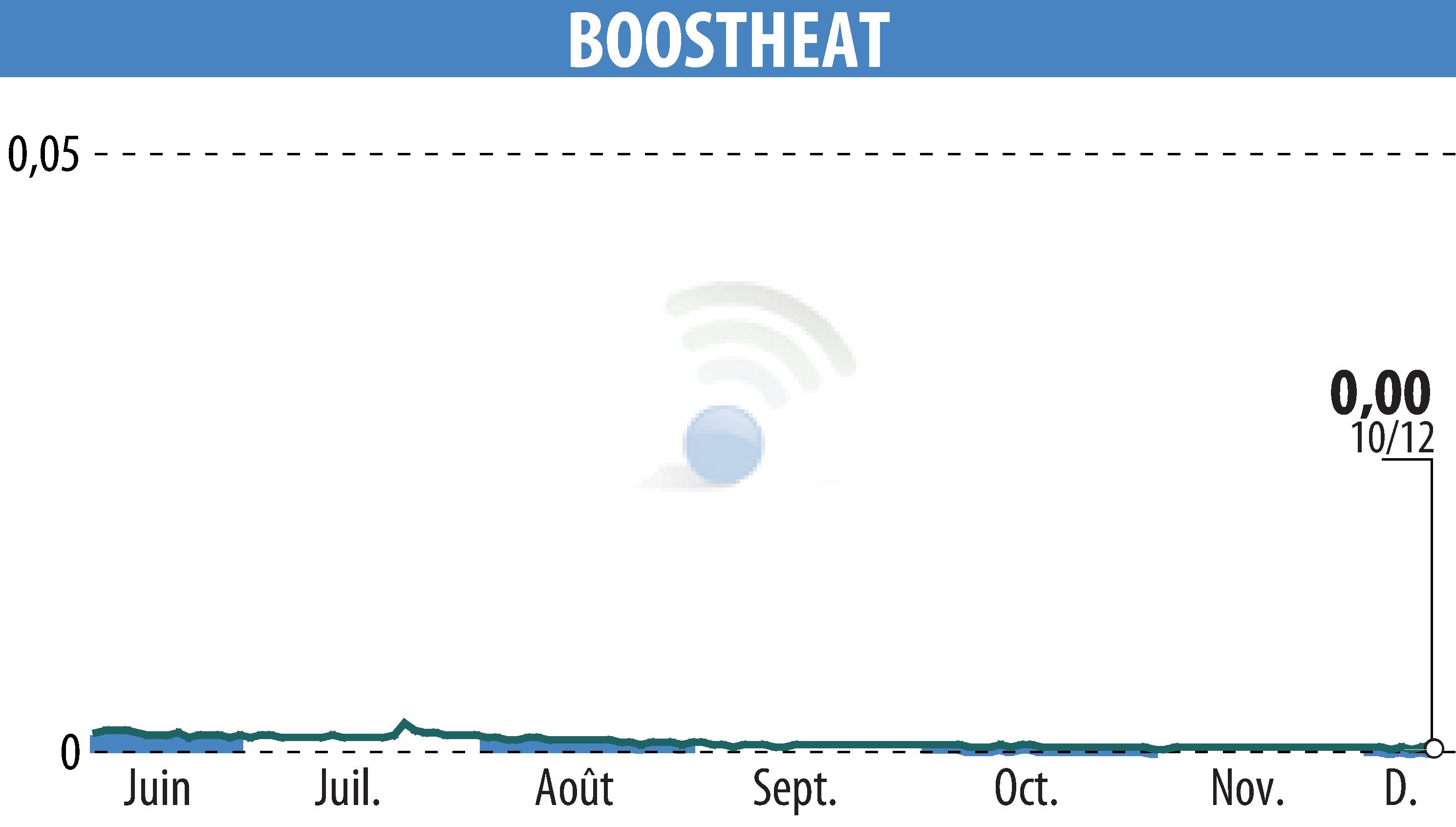

on BOOSTHEAT (EPA:ALBOO)

Fundraising and capital adjustment at BOOSTHEAT

BOOSTHEAT, a French company specializing in energy efficiency, has raised €125,000 through a convertible bond issue subscribed by Impact Tech Turnaround Opportunities (ITTO). This transaction aims to support the company's strategy under its new management and maintain a healthy cash flow.

The issuance, which could generate up to 782,894,736 new shares, could reduce a shareholder's stake from 1% to 0.97%, based on the latest quoted price. Adding to this dynamic, BOOSTHEAT has decided to reduce its par value per share from €0.0005 to €0.0001, thereby adjusting its share capital to €168,299.1067.

These decisions are part of a progressive dilutive financing strategy, with shares being sold by ITTO on the market.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all BOOSTHEAT news