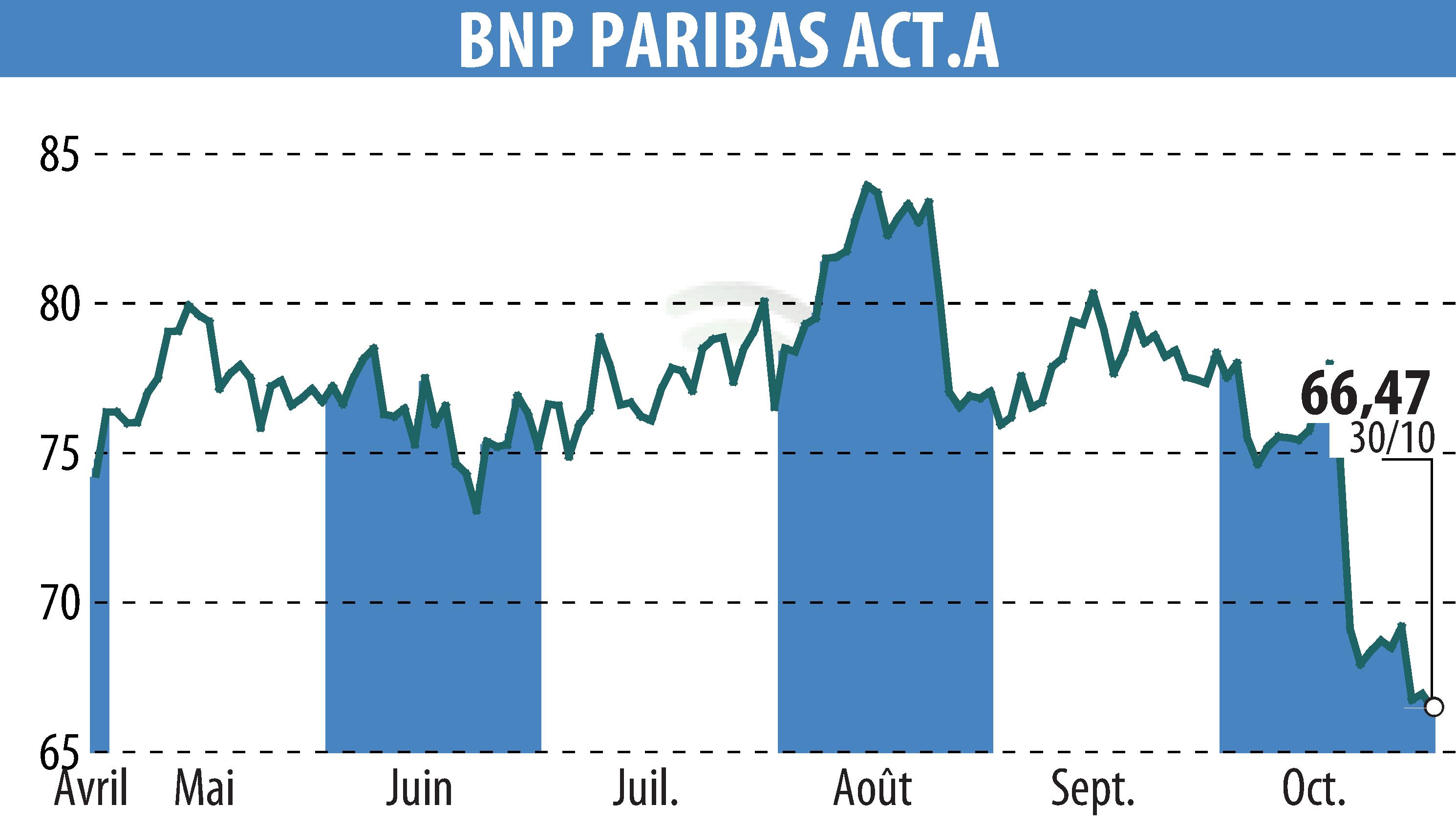

on BNP PARIBAS (EPA:BNP)

BNP Paribas Sees Reduced P2R Requirements for 2026

BNP Paribas has announced the reduction of its Pillar 2 Requirement (P2R) following the 2025 Supervisory Review and Evaluation Process (SREP) by the European Central Bank. As of January 1, 2026, the P2R is set at 1.73%, a decrease of 11 basis points from 2024. The Common Equity Tier 1 (CET1) requirement will be 10.44%, which includes various buffers such as a 1.05% P2R, and others.

The Tier 1 Capital ratio requirement is set at 12.23%, and the Total Capital ratio at 14.62%. The leverage ratio remains unchanged at 3.85%. As of September 30, 2025, BNP Paribas' capital levels are significantly above these regulatory requirements, demonstrating strong capital structure and prudent balance sheet management.

The group's positive stress test results have placed it in the ECB’s first bucket for Pillar 2 Guidance, indicating robust capital management.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all BNP PARIBAS news