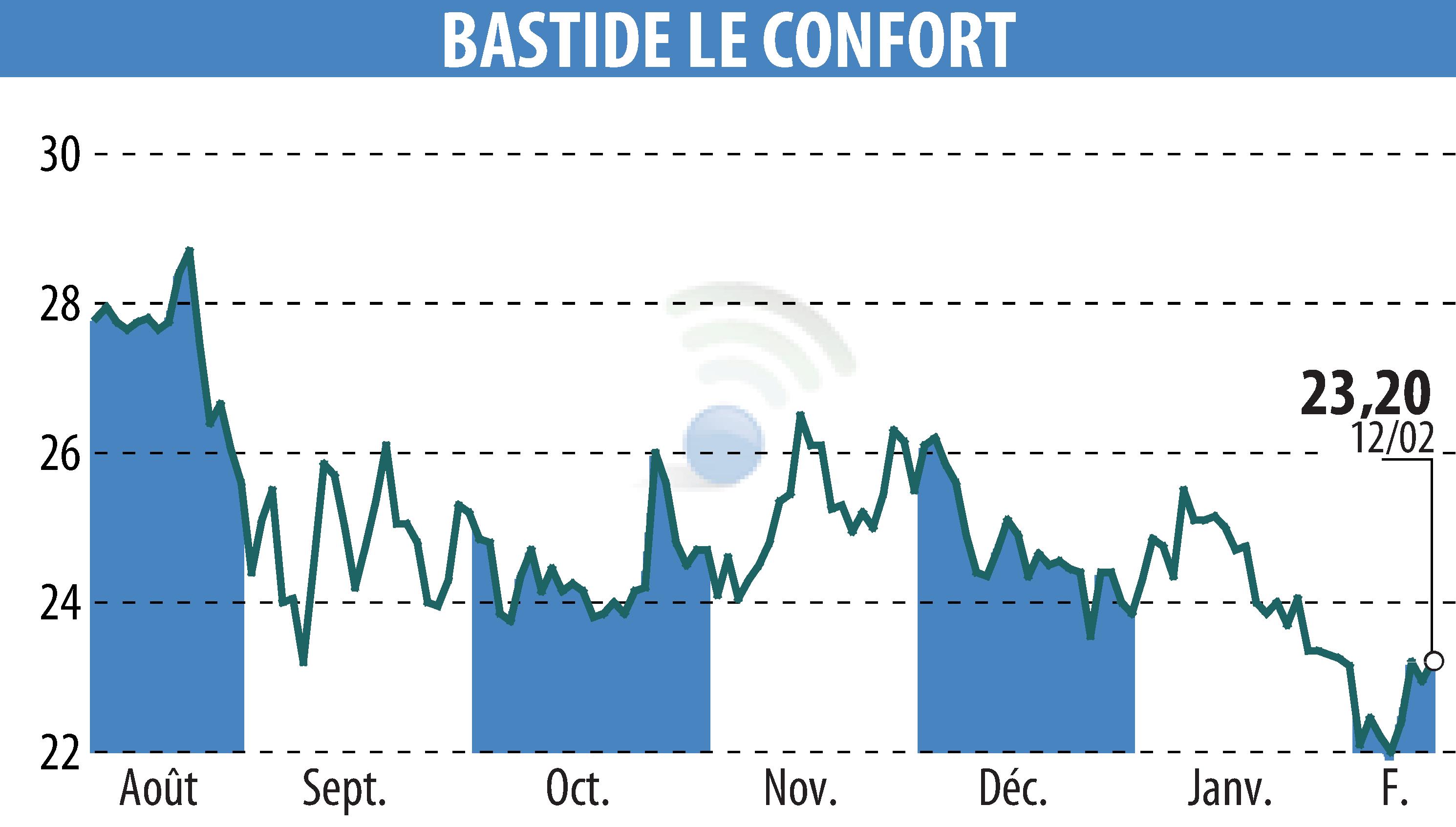

on BASTIDE (EPA:BLC)

Bastide's Robust First-Half Growth in 2025-2026

Groupe Bastide, a prominent European home healthcare provider, reported a robust 8.0% increase in revenue, reaching €260.4 million for the first half of 2025-2026. The company achieved an impressive organic growth rate of 8.2%, despite facing a 5% price reduction in the sleep apnea segment since April 2025.

The Homecare business soared with a revenue of €101.4 million, growing by 6.5%. This was largely driven by the exponential growth of rental activities within healthcare and store channels. The Respiratory business also performed well, recording a 10.4% increase in revenue due to market expansion in Europe and new contracts in Canada.

Meanwhile, the Nutrition-Perfusion-Diabetes-Stomatherapy segment advanced with a 7.2% growth, highlighted by the strong Diabetes sector. Looking ahead, Bastide aims for a conservative target of at least €510 million in annual revenue for the fiscal year, focusing on debt reduction and maintaining a robust operating margin.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all BASTIDE news