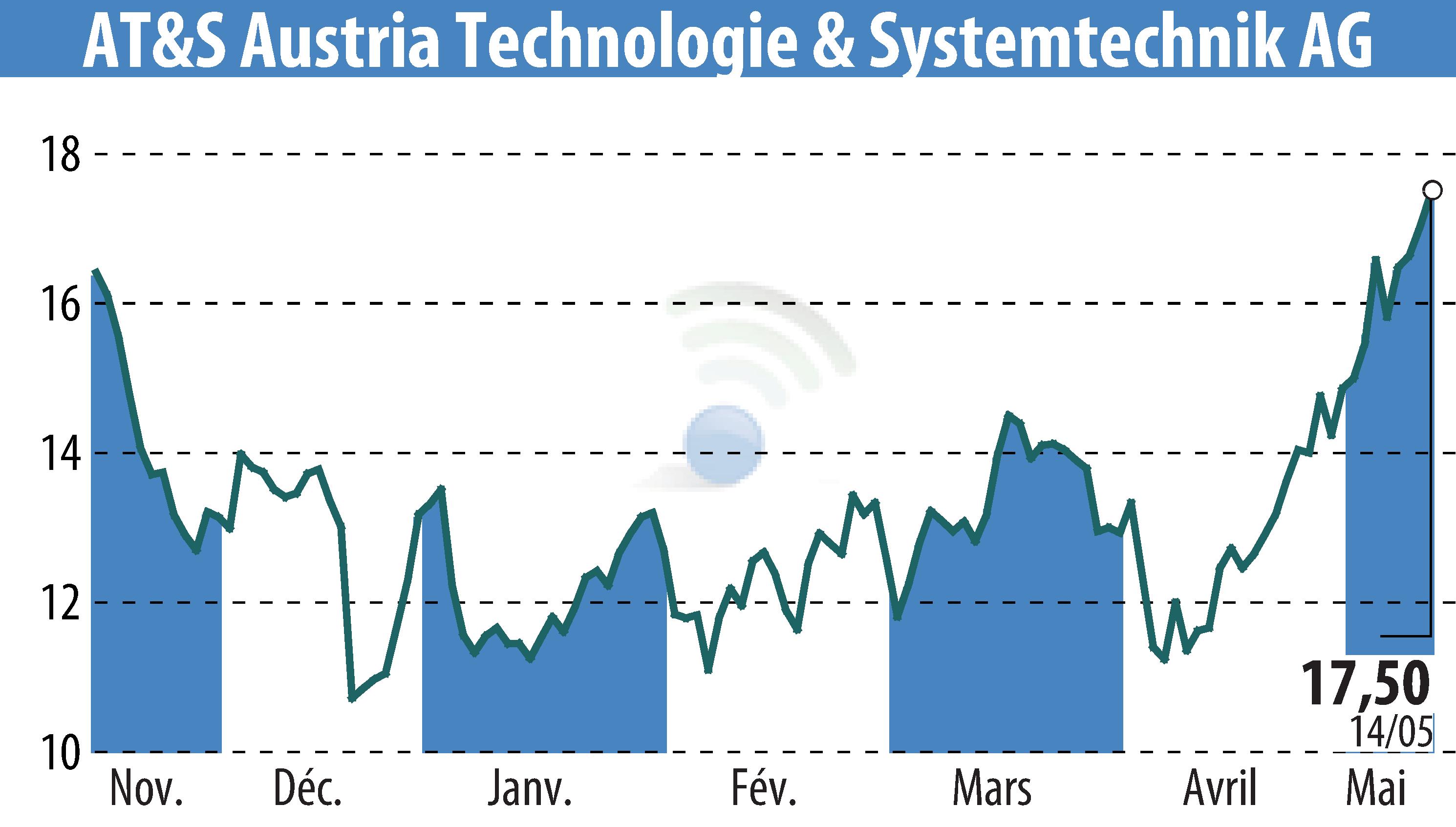

on AT&S Austria Technologie & Systemtechnik AG (ETR:AUS)

AT&S Records Revenue Growth Amid Market Challenges

AT&S Austria Technologie & Systemtechnik AG reported an increase in revenue to €1,590 million for the financial year 2024/25, amid challenging market conditions. The sale of its Korean plant contributed to a profit of €90 million. Despite high price pressures, AT&S managed to slightly raise revenue compared to the previous year.

EBITDA saw a significant rise by 97%, reaching €606 million, largely due to the Korean plant sale. Adjusted for related costs, EBITDA stood at €408 million, marking a 6% increase. The EBITDA margin improved to 25.7%, with the reported margin at 38.1%.

Strategic cost optimization programs continue robustly, with aims to save an additional €130 million. Despite positive EBITDA growth, cash flow from operations was negative, recorded at €-75 million.

AT&S forecasts continued market pressures, particularly in automotive and industrial segments. The upcoming financial year will see strategic investments, especially in IC substrate production, with anticipated revenue growth to €400 million in Q1 2025/26.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all AT&S Austria Technologie & Systemtechnik AG news