on ATOSS Software AG (ETR:AOF)

ATOSS Software SE: Strong Positioning Promises Growth

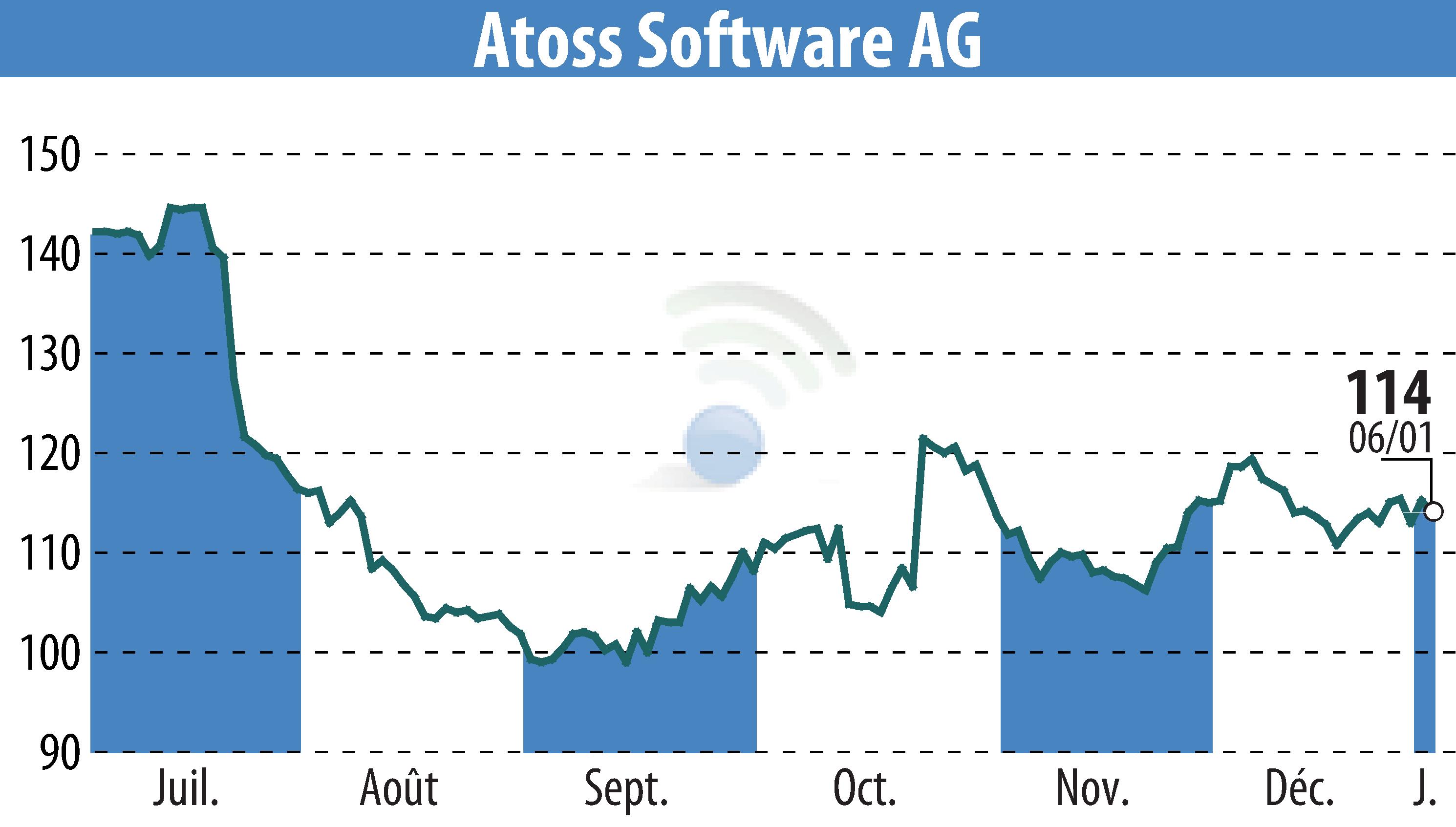

A recent research update by NuWays AG reaffirms a "BUY" recommendation for ATOSS Software SE with a target price of EUR 152. Going into FY26, ATOSS is expected to benefit from a strong position in the Workforce Management (WFM) market. The company has navigated FY25's challenges, including cautious customer sentiment, by showcasing business model resilience.

In FY25, recurring revenues hit 70%, and Annual Recurring Revenue (ARR) rose by 17% year-on-year to €134m. Cost management resulted in a 34.6% EBIT margin, prompting an improved FY25 outlook. As FY26 unfolds, deferred IT investments and cloud migration will drive a projected 13.1% revenue growth to €214m. New AI offerings may further enhance the value proposition.

The company's EBIT margins are predicted to remain robust at 34.7% for FY26, thanks to a scalable SaaS model. ATOSS holds a net cash position of €116m, maintaining strategic flexibility. Despite a demanding valuation, the long-term growth potential underscores the "BUY" rating.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ATOSS Software AG news