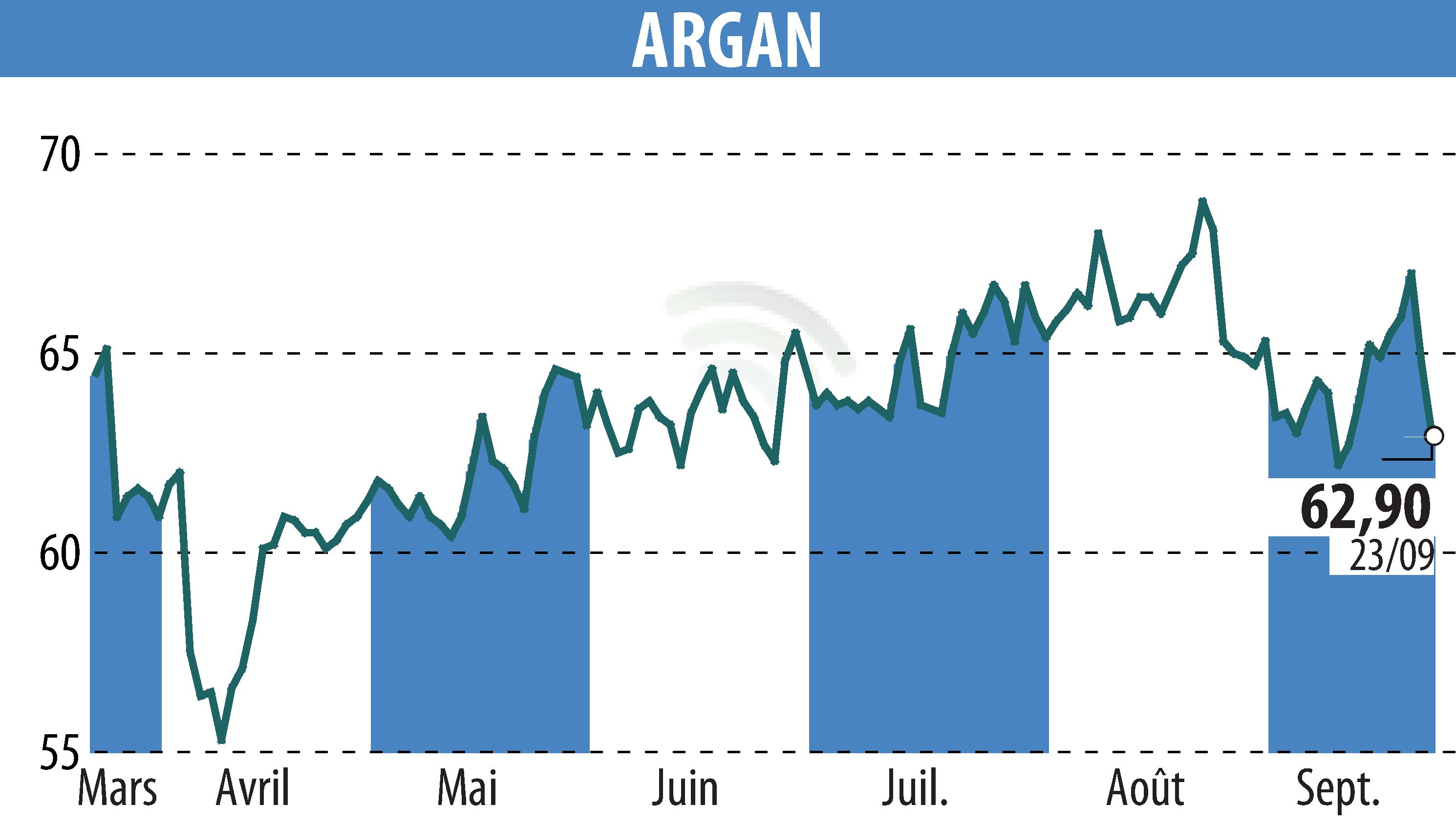

on ARGAN (EPA:ARG)

ARGAN Maintains its “Investment Grade” Rating with S&P

ARGAN, a company specializing in the development and leasing of warehouses, maintains its investment-grade rating with S&P Global Ratings. The rating remains at "BBB-" with a "stable" outlook, in line with the company's adequate debt levels, despite the CARAT portfolio's withdrawal from the market.

S&P's decision comes after ARGAN announced its intention to maintain an EPRA LTV ratio excluding duties at 41.5% and a net debt to EBITDA ratio of 8.7 times by the end of 2025. The warehouse portfolio of approximately €130 million will not be sold.

S&P reiterates its confidence in ARGAN's ability to maintain regular cash flows and refinance its €500 million debt maturing in November 2026. The company's asset strength is also highlighted.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ARGAN news