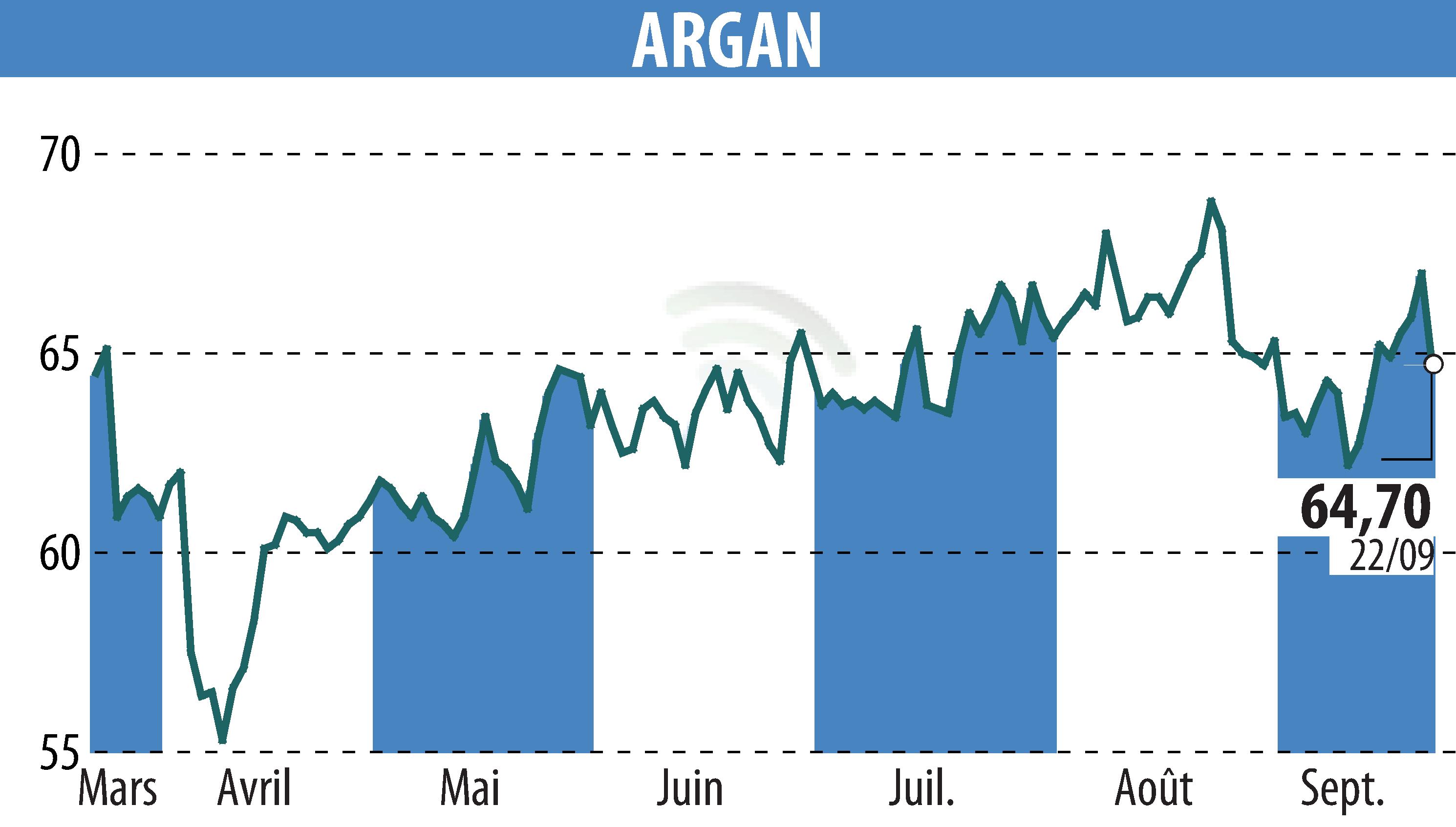

on ARGAN (EPA:ARG)

ARGAN Adjusts its Financial Strategy in the Face of Economic Challenges

ARGAN, a French real estate company specializing in premium warehouses, is adapting its 2025 financial targets in response to a changing economic environment. The company initially planned to sell assets to reduce its debt, but rising French interest rates, fiscal uncertainties, and the collapse of the government have changed its plans. ARGAN has withdrawn its CARAT portfolio from the market.

The LTV debt ratio is now anticipated at 41.5%, compared to an initial target of 40%. Despite these adjustments, the company expects a 7% increase in rental income, reaching €211 million, and an 11% increase in recurring net income. The dividend of €3.45 per share is confirmed. ARGAN maintains its ability to finance its operations and future investments.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ARGAN news