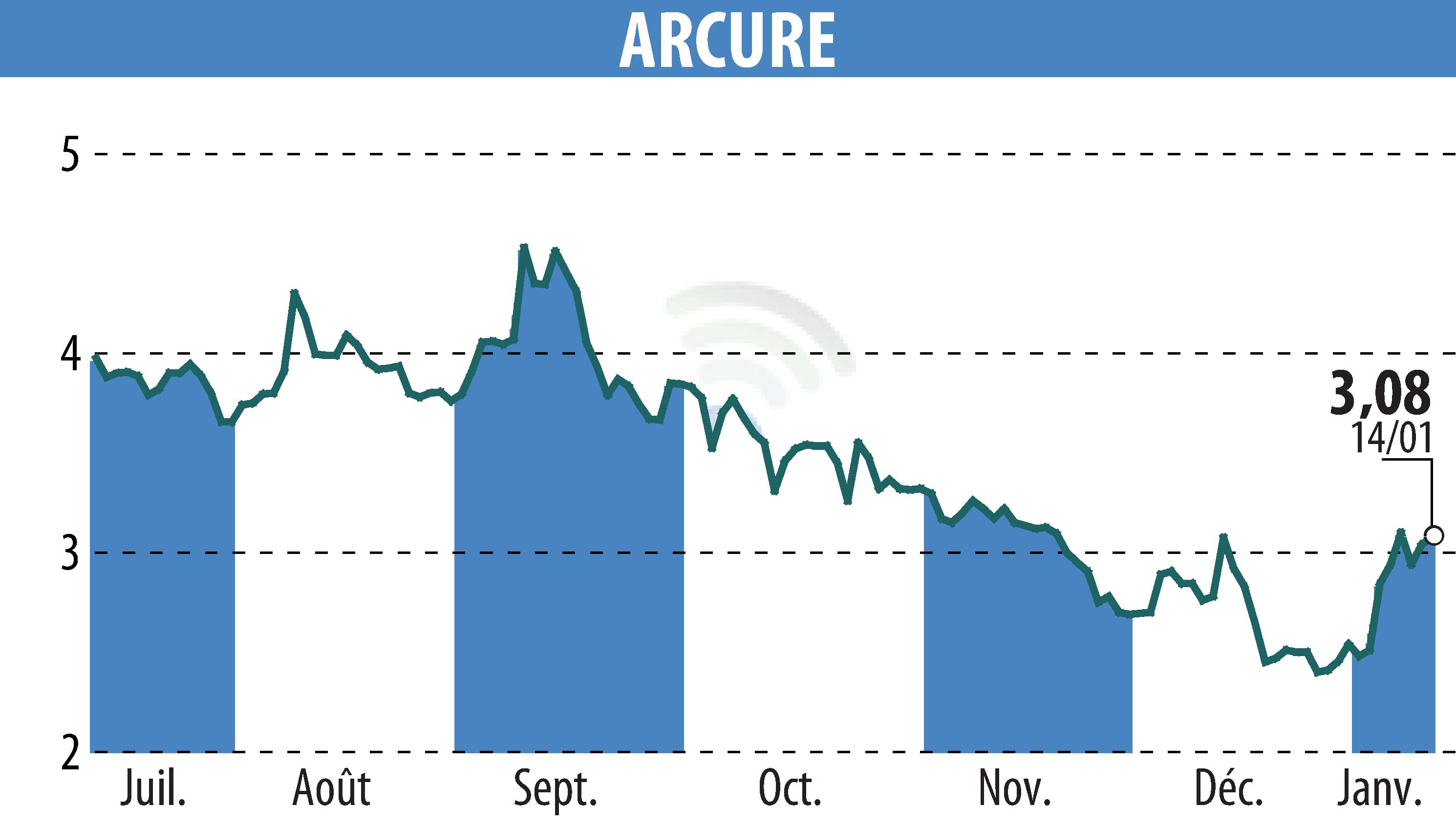

on ARCURE (EPA:ALCUR)

Arcure confirms its redeployment in AI despite declining sales

Arcure announced revenues of €12.6 million for 2025, down from €18.7 million in 2024. This decrease is attributed to weak OEM sales prior to the Jungheinrich contract. Nevertheless, international sales account for 73% of its revenue, with 43% coming from Europe and 21% from North America.

The company is refocusing on its core business by intensifying its presence in the embedded AI market, notably by developing advanced algorithms to meet the intelligent perception needs of OEMs.

Arcure also introduced the Blaxtair AHD, a competitive entry-level product that has proven popular in the market. In 2025, the company conducted more than 20 OEM negotiations, paving the way for significant future contracts starting in 2026. Furthermore, careful cost control has enabled the company to reduce its fixed cost base by €1.7 million.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ARCURE news