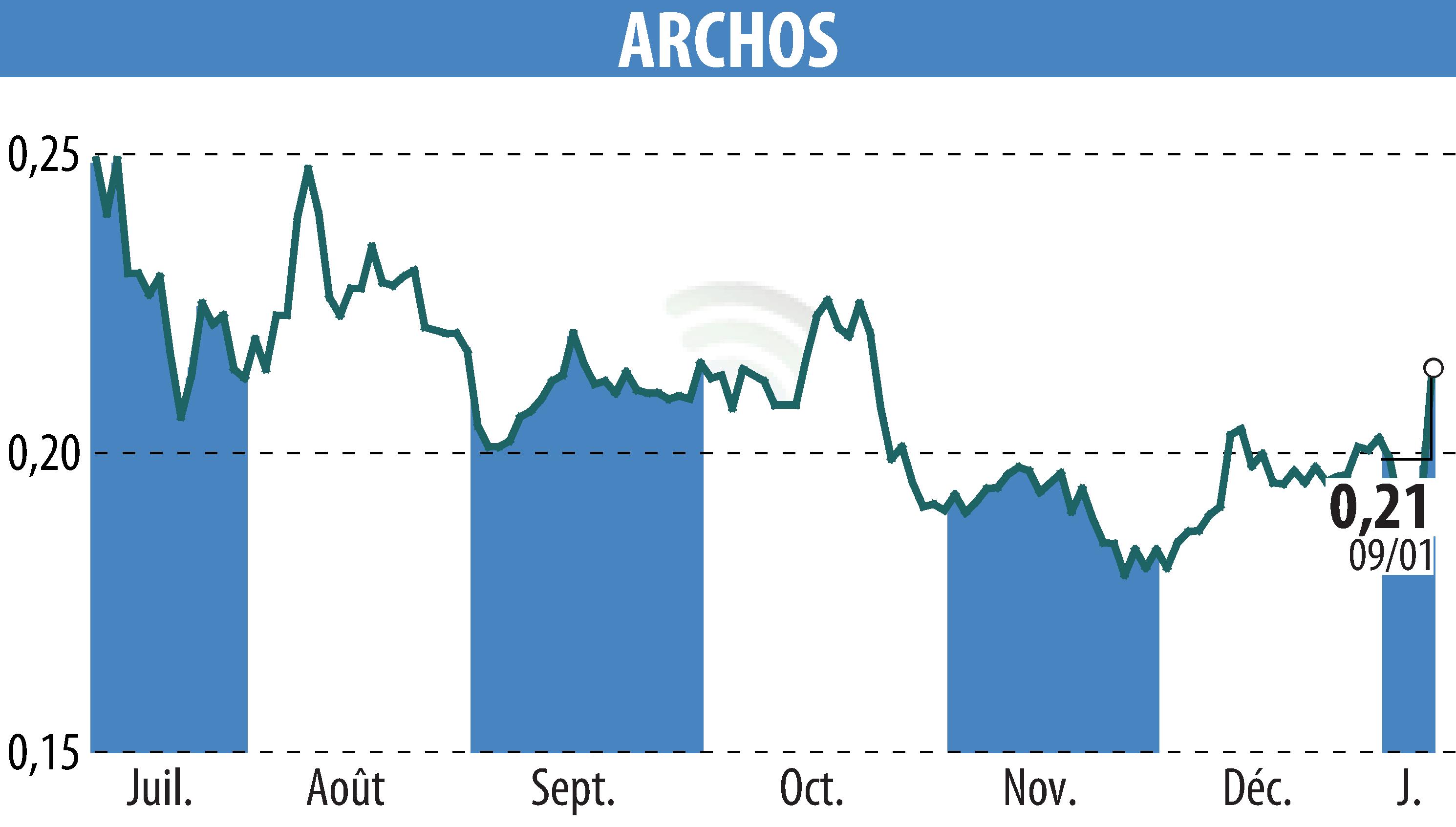

on ARCHOS (EPA:ALJXR)

ARCHOS: Revenue growth of 53% in 2025, 91% expected in 2026

ARCHOS, a specialist in mobile and rugged technologies, announces a significant increase in its turnover, reaching approximately 48 million euros in 2025, a rise of 53% compared to 2024. For 2026, optimistic forecasts predict a turnover of 92 million euros, representing an increase of 91%.

Among the growth drivers, strengthening its presence in the French and German defense markets is crucial. The integration of O2i Ingénierie transforms ARCHOS into a major player in digital transformation, with solutions integrating artificial intelligence and cybersecurity. The factory in Essonne, operational by the end of March 2026, will reinforce the group's sovereignty.

The acquisitions of the Logic Instrument group, development in the MedTech sector, and the exploration of new acquisition opportunities in the defense industry are driving growth. ARCHOS aims to enhance its expertise in defense and industry.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ARCHOS news