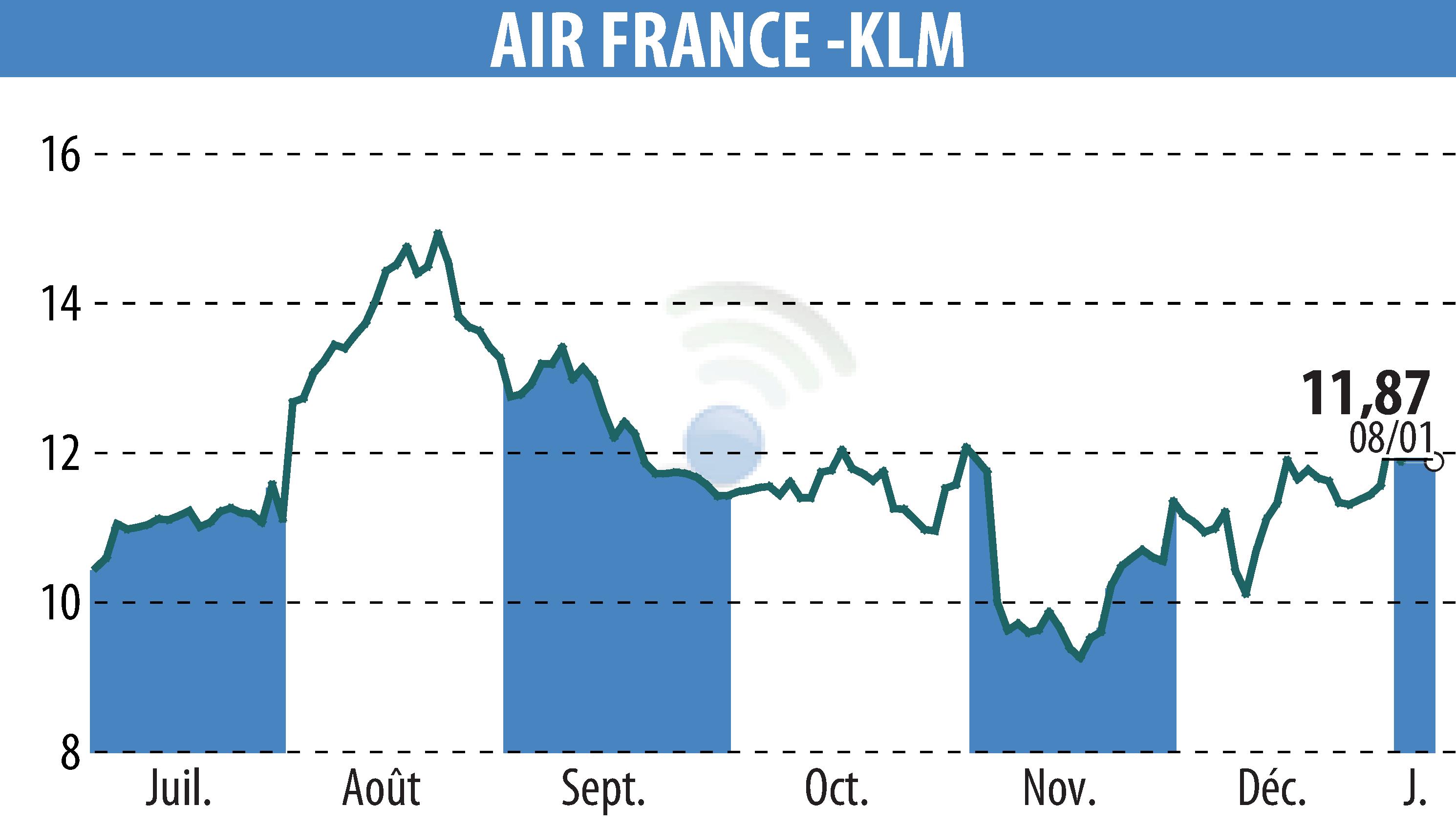

on AIR FRANCE-KLM (EPA:AF)

Air France-KLM successfully raises €650 million through a bond issue

Air France-KLM has announced the successful issuance of €650 million in bonds under its EMTN program. This placement consists of 5-year senior unsecured bonds with a fixed coupon of 3.875%. The yield is 4.033%.

The transaction attracted over 150 orders from institutional investors, with an order book exceeding €3.5 billion. This strong demand allowed the size of the initially planned issue to be increased from €500 million to €650 million, while securing the Group's lowest credit margin.

The funds will be used for the Group's general financing needs and to repay a tranche of its long-term debt in 2026. Air France-KLM's long-term debt is rated BB+ and BBB- by S&P and Fitch. JP Morgan, Morgan Stanley, and Société Générale coordinated the transaction.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all AIR FRANCE-KLM news