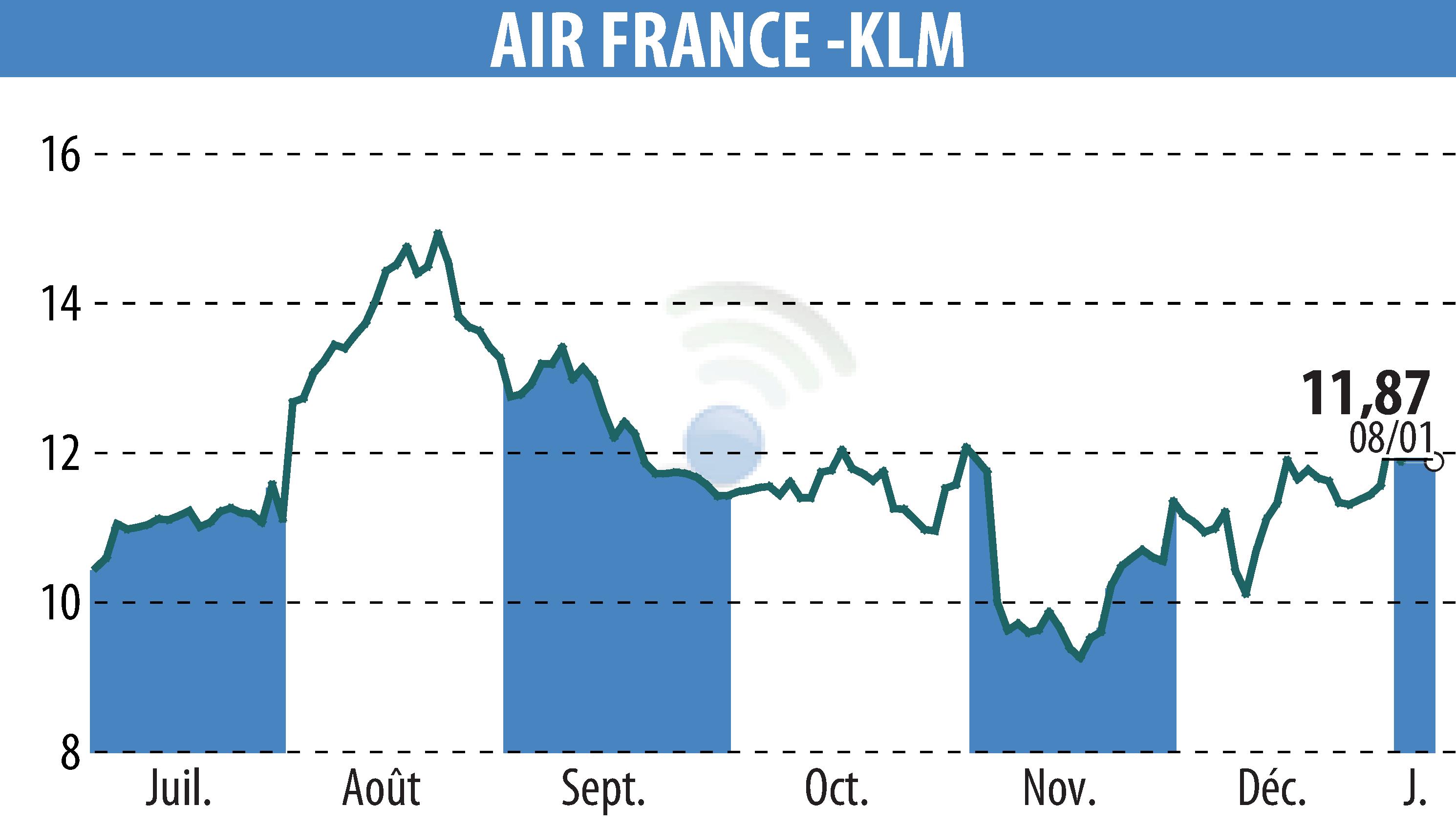

on AIR FRANCE-KLM (EPA:AF)

Air France-KLM Secures €650 Million Through EMTN Program

Air France-KLM has successfully issued €650 million in senior unsecured notes under its Euro Medium Term Notes (EMTN) Program. These notes, with a five-year maturity, offer a fixed annual coupon of 3.875% and a yield set at 4.033%. The decision capitalizes on favorable market conditions, helping the group lengthen its debt maturity profile.

The issuance received significant interest, with over 150 orders, leading to an orderbook surpassing €3.5 billion. This allowed Air France-KLM to increase the size of the issuance from €500 million to €650 million, achieving its lowest credit spread to date. The robust demand underscores investor confidence in the company's credit quality and financial strategy.

The funds are earmarked for general corporate needs and to redeem the first tranche of its Sustainability Linked Bonds in May 2026. Air France-KLM's long-term debt ratings stand at BB+ from Standard & Poor's and BBB- from Fitch Ratings.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all AIR FRANCE-KLM news